| Categories | Anticipated risks and opportunities | Impact on the Group | Business impact*1 | Countermeasures | ||||

|---|---|---|---|---|---|---|---|---|

| 2030 | 2050 | |||||||

| 1.5℃ | 4℃ | 1.5℃ | 4℃ | |||||

| Transition risk | Political and legal/regulatory (carbon pricing) |

·Abrupt changes in fuel prices ·Electrical fees due to adoption of environmentally friendly vehicles |

·Fluctuations in shipping fuel costs | Intermediate(+) *2 |

Intermediate | Intermediate | Intermediate |

·Adoption of environmentally friendly vehicles (EVs, HVs, LNG, environmentally friendly DSL, etc.) and tandem-trailer trucks ·Implementation of a modal shift ·Study of adoption of technologies such as FCVs and LNG- and ammonia-powered ships ·Initiatives as a GX League participating company |

| ·Introduction of regulations such as carbon taxes | ·Increased cost burden | Significant | - | Significant | - | |||

| Technical (delays in renewable energy and energy-saving technologies) |

·Difficulty in achieving greenhouse gas reduction targets | ·Increased cost of procuring renewable energy, energy savings, and carbon credits | - |

·Management of the Group’s energy use and implementation of energy-saving measures ·Acquisition of renewable energy-derived power |

||||

| Market (growth/contraction of customer base) |

·Selection of low-carbon services by customers | ·Stagnating market share in the event SENKO fails to provide low-carbon services | Significant | - | Significant | - |

·Disclosure of CO₂ emissions, including Scope 3 ·Visualization of CO₂ emissions ·Provision of options geared to further decarbonization, for example use of environmentally friendly vehicles and ships, implementation of a modal shift, and consolidation of logistics facilities |

|

| Physical risk | Acute (extreme weather) | ·Interruptions in road, rail, marine, and air freight service | ·Increased cost of continuing to operate our logistics business (equipment damage not covered by insurance, etc.) | - | - | Low | Low |

·BCP development and training ·Acquisition of supplies ·Support and partnership among facilities ·Decentralization of facilities ·Provision of alternative shipping routes |

| Chronic (sea level rise) |

·Need for measures to deal with flood damage at logistics facilities and to reconsider where they are located | ·Increased costs, for example to assess risk at, and relocate, logistics facilities | - | |||||

| Chronic (temperature rise) |

·Heat illness risk ·Increased employee attrition |

·Increased employee health impacts ·Increased costs in areas such as insurance premiums and hiring |

- |

·Realization of a safe labor environment ·Promotion of automated and unmanned technologies ·Cultivation of employee awareness of health and safety; strengthening of initiatives to promote health |

||||

| Opportunities | Technical (adoption of renewable energy and energy-saving technologies) | ·Increased use of renewable energy and energy-saving technologies, for example switching to renewable energy |

·Stable supply of low-cost, low-CO₂ energy ·Revenue from the sale of privately generated power |

- |

·Installation of solar power equipment and private consumption of generated power ·Installation of LED lighting and curtailment of air conditioner use ·Transition to solar power, wind power, and other renewables |

|||

| Technical (progress in next-generation technologies) | ·Increased adoption of next-generation logistics technologies that improve vehicle loading and operational efficiency, for example joint logistics services |

·Savings in logistics costs, for example due to implementation of a modal shift and adoption of tandem-trailer trucks ·Reduced CO₂ emissions |

Intermediate | - | Intermediate | - | ·Proposal of logistics services that take into account climate change risk, for example optimized shipping patterns and optimized shipping routes | |

| Market (next-generation energy transport) |

·Increased demand for liquefied hydrogen shipped by tanker trucks as fuel cell-powered trucks enter into widespread use ·Increased demand for liquefied ammonia shipment via ships |

·Increased revenue related to liquefied hydrogen and liquefied ammonia shipment | Low | - | Intermediate | - | ·Expansion of existing businesses and development of next-generation energy shipping structures | |

| Market (circular economy) | ·Increased reuse and recycling of EV batteries, solar panels, and waste plastic | ·Increased revenue related to logistics services related to reuse and recycling | Low | - | Low | - |

·Targeting of existing and new customers based on demand for measures to deal with climate change ·Development of logistics platforms |

|

| Reputational (stakeholder reputation) | ·Praise from investors and others in response to accurate disclosure of information about how we are addressing climate change risk | ·Increased corporate value and fund procurement under better terms | - |

·More extensive disclosure of information to stakeholders ·Fund procurement using means such as green bonds |

||||

SENKO HOLDINGS

Disclosing Information in Accordance with TCFD Recommendations

Compliance with the recommendations of the Task Force on Climate-related Financial Disclosures

Basic approach

The SENKO Group recognizes that dealing with climate change is a key priority in the effort to protect the global environment and a material factor (materiality) in its implementation of sustainable management. Consequently, the Group has undertaken a serious effort to address climate change. It signed the United Nations Global Compact in October 2020, and takes action in support of the implementation of principles related to addressing environmental issues and other priorities. Having endorsed the Task Force on Climate-related Financial Disclosures (TCFD) in September 2022, we disclose information related to climate change to facilitate good communication with a broad range of stakeholders, including shareholders and investors.

Governance

The Group’s Sustainability Policy commits it to “deliver new value by helping realize a sustainable environment and society, working to achieve sustained growth for the Group, and connecting people and society through its various businesses,” and we follow that strategy by striving to provide value to help resolve a variety of challenges.

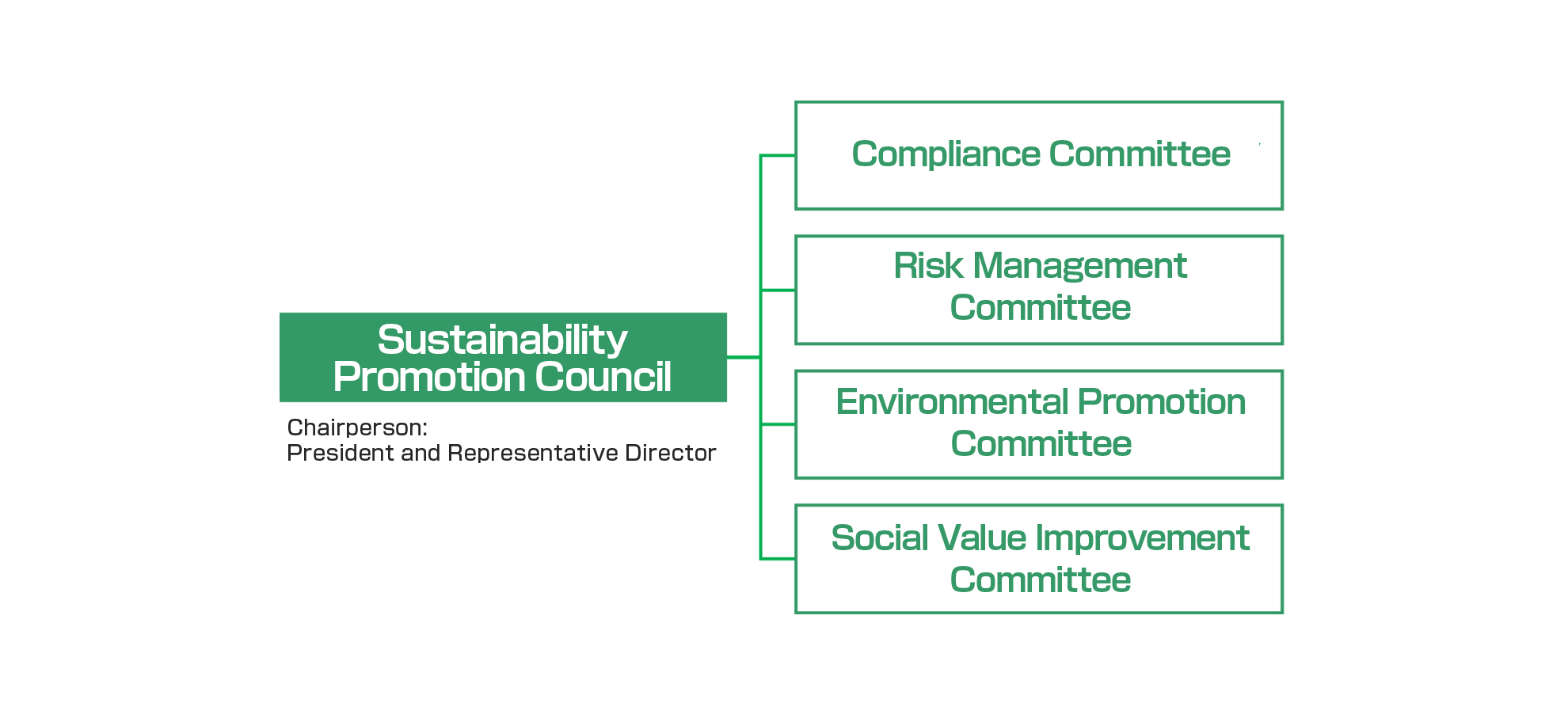

To implement the policy, Compliance, Risk Management, Environmental Promotion, and Social Value Improvement Committees are involved in a variety of activities related to sustainability. Furthermore, our Sustainability Promotion Council, which meets twice a year and which oversees those committees as well as the Sustainability Promotion Department, discusses important matters and reports to the Board of Directors on topics such as the content of its discussions and the results of related activities. The Board of Directors, which oversees the Council, accepts reports from the Sustainability Promotion Council on topics such as the content of its discussions and the results of related activities.

The Sustainability Promotion Council, which is chaired by the president and representative director, who has final responsibility for all sustainability-related initiatives, consists of outside directors and other executives. The Sustainability Promotion Department, which is overseen by the Sustainability Promotion Council, works on an operational level with sustainability officers and sustainability coordinators from major Group companies and business headquarters to undertake various initiatives and reports on related matters to the Sustainability Promotion Council.

Against the backdrop of the growing global importance of sustainability-related initiatives such as Environment-Social-Governance (ESG) management and the Sustainable Development Goals (SDGs), we analyzed material factors (materiality) based on the continual evolution of megatrends with the potential to impact the Group’s businesses. Specifically, we consulted standards published by the Sustainability Accounting Standards Board (SASB)* and determined that our operations span 28 of the 77 industries identified by the SASB. We estimated each industries’ importance as a percentage of our sales and its potential impact on our businesses and then identified issues that need to be addressed through our businesses based on the materiality required for those 28 sectors. We established material factors (materiality) related to environment (E), social (S), governance (G), and health (H) management based on a close examination of their relationships with key measures in the Group’s management.

* The U.S.-based Sustainability Accounting Standards Board (SASB) published a series of standards on the disclosure of non-financial information in 2018.

Risk Management

The Group treats “realizing sustained growth for the Group by helping realize a sustainable environment and society” as a core policy as it strives to create new value while connecting people and society through its various businesses.

In keeping with the above policy on sustainability, we are working to solve environment (E), social (S), governance (G), and health (H) challenges, and we consider action addressing climate change to be a top priority.

The Risk Management Committee identifies risks that the Group faces or could face in the future and undertakes appropriate preventive and remedial measures on an organizational basis to address them. Furthermore, as one way to address climate change, it has established a Natural Disaster Risk Subcommittee to boost the Group’s resilience by inspecting and reviewing business continuity plans (BCP) and other contingencies.

In addition to formulating Environmental Action Policies governing environmental protection activities and environmental impact reduction activities and spreading awareness of them among employees and other workers at worksites, the Environmental Promotion Committee manages environmental targets concerning goals such as reduction of CO₂, use of renewable energy, and recycling of waste. The Committee also reports on progress towards the Group’s environmental targets to the Sustainability Promotion Council.

The Sustainability Promotion Council discusses important matters based on reports from the Risk Management Committee, Environmental Promotion Committee, and other bodies and reports to the Board of Directors on topics such as the content of its discussions and the results of related activities. The Board of Directors accepts reports related to risk management from the Sustainability Promotion Council, which it oversees.

Scenario analysis

During FY2023, we conducted a scenario analysis of risks and opportunities associated with climate change based on the TCFD framework for our flagship Logistics business, as well as our Trading & Commerce, Business Support, and Living Support businesses, where climate change is likely to have a smaller impact. This effort entailed identifying specific transition and physical risks and opportunities and studying medium- and long-term measures to address them.

With regard to our flagship Logistics business, we evaluated the extent of financial impacts under the 1.5℃ and 4℃ scenarios for 2030 and 2050 for those risks and opportunities which we consider important and studied how to apply the results to strategies affecting investment and financing.

(Logistics business)

-

*1:We evaluated business impacts by calculating financial impacts on SENKO under each scenario in terms of effects on operating profit and evaluated the results using a three-stage scale (significant, intermediate, and low). “Significant” indicates an impact of greater than 5 billion yen; “intermediate,” an impact of 1 to 5 billion yen; and “low,” an impact of less than 1 billion yen. A dash indicates that impacts were not evaluated based on our assessment that the magnitude of any impact at present would be small.

The scenario analysis drew on resources including “World Energy Outlook 2022” (crude oil prices) and “World Energy Outlook 2021” (carbon tax prices), both published by the IEA. - *2:Since fuel costs are expected to decline under the 1.5℃ scenario, the financial impact is positive despite being classified as a risk.

(Trading & Commerce, Living Support, and Business Support businesses)

| Categories | Anticipated risks and opportunities | Impact on the Group | Impacted businesses | Countermeasures | |||

|---|---|---|---|---|---|---|---|

| Trading & Commerce | Living Support | Business Support | |||||

| Transition risk | Political and legal/regulatory (carbon pricing) |

·Increased shipping and procurement costs ·Increased costs associated with regulatory strengthening |

·Increased logistics costs | 〇 |

·Consolidation of logistics in SENKO’s logistics group ·Reassessment of shipment frequency |

||

| ·Increased energy procurement costs | 〇 | 〇 | 〇 | ·Use of solar power self-consignment at SENKO Group facilities | |||

| ·Increased raw material procurement costs | 〇 | 〇 | ·Pursuit of joint procurement within the SENKO Group | ||||

| Technical (development of environmentally friendly products and services) |

·Increased product and service development costs | ·Increased product development costs | 〇 |

·Creation of structures for developing environmentally friendly products and services ·Pursuit of joint research within the Group |

|||

| ·Increased service development costs | 〇 | 〇 | 〇 | ||||

| Market (increased demand for environmentally friendly products and services) |

·Selection of environmentally friendly products and services by customers ·Displacement from markets due to environmentally unfriendly products |

·Stagnating market share if SENKO fails to supply environmentally friendly products and services | 〇 | 〇 | 〇 | ||

| Physical risk | Acute (extreme weather) |

·Extensive damage to facilities, equipment, inventory, real-estate properties, etc. | ·Increased costs associated with business continuity | 〇 | 〇 | 〇 |

·BCP development and training ·Acquisition of supplies ·Decentralization of suppliers and facilities ·Support and partnership among facilities ·Development of a safe labor environment ·Cultivation of employee awareness of health and safety; strengthening of initiatives to promote health |

| ·Interruptions to business due to supply chain disruptions | ·Sales opportunity losses due to interruptions in store and facility operation | 〇 | 〇 | 〇 | |||

| ·Increased human toll for employees and customers due to extreme weather | ·Increased employee health impacts | 〇 | 〇 | 〇 | |||

| Chronic (sea level rise) |

·Need for measures to deal with flood damage to stores and facilities and need to reconsider where they are located ·Development of structures (information and logistics networks) for supplying products in a sustainable manner |

·Increased costs, for example to assess risk at, and relocate, stores and facilities | 〇 | 〇 | |||

| Chronic (temperature rise) |

·Increase in heat illness risk experienced by employees due to rising temperatures ·Human toll of increased tropical infectious diseases |

·Increased employee health impacts and attrition | 〇 | 〇 | 〇 | ||

| Opportunities | Technical (adoption of renewable energy and energy-saving technologies) |

·Increased demand for accurate assessment of CO₂ emissions, including Scope 3 | ·Increased demand for services related to the accurate assessment, visualization, and reduction of CO₂ emissions | 〇 | ·Development and provision of services that utilize expertise accumulated through SENKO’s logistics business | ||

|

·Utilization of green energy ·Progress in equipment incorporating energy-saving technologies |

·Reduced costs due to SENKO’s adoption of equipment with green energy and state-of-the-art energy-saving technologies at its facilities | 〇 | 〇 | ·Research into, and active adoption of, next-generation energy and next-generation technologies | |||

| Market (circular economy) |

·Increased demand for environmentally friendly products and services | ·Increased demand for alternative products due to progress in reduced use of plastics | 〇 | ·Strengthened development of products that use recycled plastic and plastic alternatives | |||

| ·Increased revenue from accommodating growing customer demand for environmentally friendly products and services | 〇 | ·Development of resource recycling mechanisms through use of the Group’s aggregate capabilities, from collection through reuse | |||||

| Market (increased catastrophic damage) |

·Increased demand for facilities that can better withstand frequent typhoons and torrential rainfall | ·Increased revenue due to increased use of disaster-resilient facilities | 〇 | ·Strengthening of disaster measures and resilience at existing facilities | |||

| Reputational (stakeholder reputation) |

·Improved reputation as a result of supplying environmentally friendly products and services ·Improved reputation as a result of improved labor environment ·Improved reputation from the perspective of business partners due to the realization of stable supply in the event of natural disasters |

·Increased brand value ·Increased corporate value and fund procurement under better terms |

〇 | 〇 | 〇 |

·More extensive disclosure of information to stakeholders ·Fund procurement using means such as green bonds |

|

Scenario analysis results and strategies

The SENKO Group is taking a variety of steps to reduce its CO₂ emissions in order to realize the goal of achieving a carbon-neutral society by 2050 as set forth in the Paris Agreement. In addition, we are working to ascertain the risks and opportunities posed by climate change in order to boost the resilience of our management, and we are involved in ongoing initiatives to maximize opportunities while dealing with the risks we have identified.

Among the serious risks we identified, an FY2023 assessment of the financial impact of the adoption of carbon tax throughout the Group calculated an impact of about 5 to 6 billion yen in 2030 assuming carbon tax pricing of USD 130 per ton of CO₂ in 2030 under the 1.5℃ scenario. With regard to the adoption of carbon tax, we will both participate in the GX League and assess associated trends while taking a variety of steps to reduce CO₂ emissions, for example through use of renewable energy and active adoption of environmentally friendly vehicles and resource-friendly tires, in an effort to lower our tax burden.

In addition, we will work with other companies to develop truck bodies and containers that help improve loading efficiency and contribute to the Group’s transport applications in an effort to develop technology for environmentally friendly vehicles. With regard to adoption of such vehicles, we will provide even lower-carbon logistics services to customers while actively undertaking investments to lower CO₂ emissions.

Through these initiatives, we will work to go beyond merely mitigating risk so that we can secure and expand opportunities.

Indicators and targets

We are taking a variety of steps to reduce its CO₂ emissions in order to realize the goal of achieving a carbon-neutral society by 2050 as set forth in the Paris Agreement.

Under the five-year Medium-term Business Plan that began in FY2023, we are striving to realize sustained business growth through environmentally oriented activities such as strategic investments using CO₂ emissions per unit of revenue in our ground transport business as the principal indicator, with a FY2027 target of realizing a 10% reduction relative to FY2021. We are not only assessing Scope 1 and 2 CO₂ emissions, but also calculating emissions both upstream (via procurement) and downstream (via shipment and beyond) of our corporate activities (i.e., Scope 3* emissions) in a more detailed manner. We are also moving ahead with an effort to calculate Scope 3 emissions for logistics operations in our customers’ supply chains and recommend efficient logistics measures.

* Scope 1: Greenhouse gases emitted directly by the company due to use of fuels.

Scope 2: Greenhouse gases emitted in the course of using supplied electricity.

Scope 3: Greenhouse gases emitted indirectly in the company’s supply chain.

For more information about our TCFD initiatives, please see pages 33 to 35 of the SENKO INTEGRATED REPORT 2023.

>

> - Environment >

- Disclosing Information in Accordance with TCFD Recommendations